Dixon Technologies (India) Limited, a leading electronics manufacturing services (EMS) provider, has consistently delivered robust performance, securing its position as a key player in the Indian manufacturing sector. Known for its expertise in producing consumer electronics, lighting products, and home appliances, Dixon has become a critical partner for global brands. This article provides an in-depth analysis of Dixon Technologies share price target 2025, factoring in its growth trajectory, market trends, and financial performance.

About Dixon Technologies

Established in 1993, Dixon Technologies is a prominent name in the EMS industry. The company operates in various verticals, including consumer electronics, home appliances, lighting, mobile phones, and security systems. Dixon is well-known for its “Make in India” commitment, leveraging state-of-the-art facilities to provide end-to-end manufacturing solutions.

With a strong client base that includes marquee brands, Dixon Technologies plays a pivotal role in meeting India’s growing demand for electronics. The company has also expanded its footprint globally, further enhancing its revenue streams.

Key Growth Drivers for Dixon Technologies

1. Growing Demand for Consumer Electronics

India’s consumer electronics market is witnessing exponential growth, driven by rising disposable incomes, urbanization, and increased adoption of smart devices. Dixon, being a leading contract manufacturer, is poised to benefit significantly from this trend.

- Televisions and Smartphones: The demand for smart TVs and mobile phones continues to rise. Dixon’s partnerships with leading brands enable it to capture a substantial share of this growing market.

- Home Appliances: Dixon’s capabilities in manufacturing washing machines and other home appliances cater to the increasing preference for quality domestic products.

2. Focus on Domestic Manufacturing

The government’s Production-Linked Incentive (PLI) scheme has provided a major boost to Dixon Technologies. The company is leveraging this initiative to scale its operations and attract new clients. The emphasis on reducing import dependence has created opportunities for Dixon to expand its presence in key segments like mobile phones and IT hardware.

About CompanyAbout Company

3. Strategic Partnerships

Dixon’s collaborations with global and domestic brands ensure a steady stream of orders. The company has partnered with industry giants, manufacturing products under their labels, which enhances its revenue and credibility.

4. Diversification into Emerging Segments

Dixon has diversified its operations into emerging areas such as wearables, IT hardware, and electric vehicle (EV) components. These high-growth sectors present immense potential for Dixon to broaden its revenue base and reduce reliance on traditional segments.

5. Expansion of Manufacturing Facilities

The company continues to invest in expanding its manufacturing capacity. New facilities equipped with advanced technology enable Dixon to scale production and meet the growing demand, both domestically and internationally.

Financial Performance

Dixon Technologies has demonstrated consistent growth in revenue and profitability, supported by its strong operational capabilities and strategic initiatives.

- Revenue Growth: The company has achieved double-digit growth in revenue, driven by increased production volumes and diversification.

- Profit Margins: Dixon has maintained healthy profit margins by optimizing costs and enhancing operational efficiencies.

- Debt Levels: The company has a manageable debt structure, enabling it to reinvest in its business without significant financial strain.

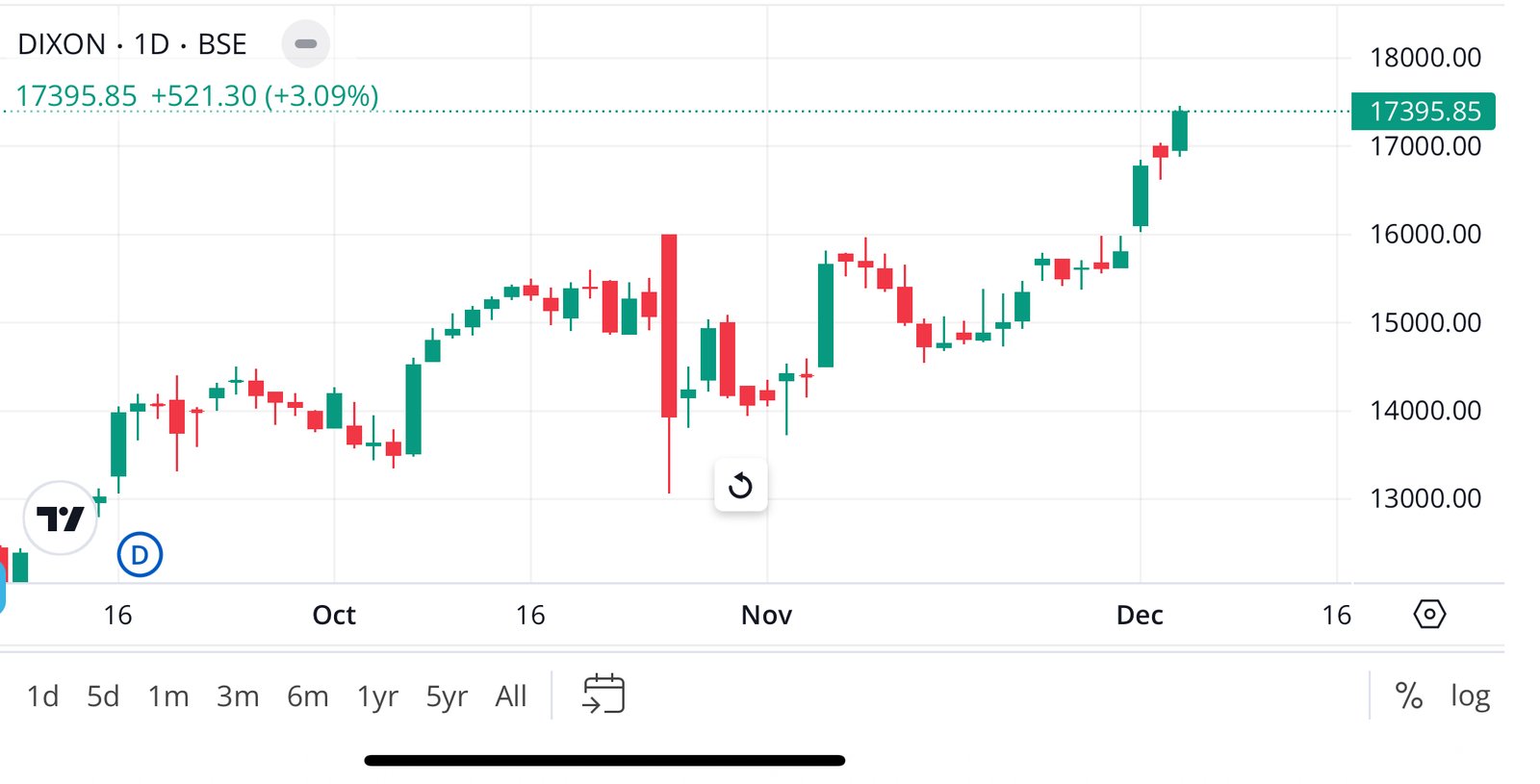

Dixon Technologies Share Price Target 2025

Based on current market trends, financial performance, and growth prospects, analysts have projected Dixon Technologies’ share price to range between ₹18,000 and ₹20,000 by 2025. This forecast reflects the company’s ability to capitalize on emerging opportunities and maintain its leadership in the EMS space.

Key Factors Influencing the Share Price

1. Impact of the PLI Scheme

The PLI scheme has provided Dixon with incentives to scale its production, particularly in high-growth areas like mobile phones and electronics. The increased capacity and government support will positively impact the company’s revenues and stock performance.

2. Rising Demand for Locally Manufactured Products

The shift towards locally manufactured products, driven by the “Vocal for Local” initiative, has strengthened Dixon’s market position. This trend will continue to benefit the company as it secures more orders from leading brands.

3. Entry into EV Components

Dixon’s foray into the EV ecosystem, including the production of batteries and chargers, opens new revenue streams. The growing adoption of EVs in India ensures a strong market for these products, contributing to Dixon’s long-term growth.

4. Global Expansion

Dixon’s strategy to expand its footprint in international markets ensures revenue diversification. The company’s ability to cater to global brands enhances its reputation and stock valuation.

Opportunities for Growth

1. Increased Focus on R&D

Dixon Technologies is investing in research and development (R&D) to innovate and stay ahead of the competition. Advanced product designs and manufacturing techniques enhance the company’s competitive edge.

2. Entry into High-Margin Products

The company’s entry into segments like IT hardware and wearables presents opportunities for higher profit margins. These sectors are characterized by strong demand and relatively low competition, offering Dixon a significant advantage.

3. Strengthening Client Relationships

By forging deeper relationships with existing clients and onboarding new ones, Dixon ensures a steady order flow. Long-term contracts and partnerships provide revenue visibility and financial stability.

Risks and Challenges

1. Dependence on Key Clients

Dixon’s business is heavily reliant on a few key clients. Any reduction in orders or loss of clients could adversely impact the company’s financial performance.

2. Supply Chain Disruptions

The electronics manufacturing industry is susceptible to supply chain challenges, particularly in sourcing raw materials like semiconductors. Disruptions could delay production and affect revenues.

3. Intense Competition

The EMS space is highly competitive, with both domestic and international players vying for market share. Dixon must continually innovate and maintain cost efficiencies to stay competitive.

Conclusion

Dixon Technologies is well-positioned to capitalize on the growing demand for electronics manufacturing, supported by favorable government policies and robust market trends. With its focus on innovation, capacity expansion, and diversification, the company is poised for long-term growth. The projected share price target of ₹18,000to ₹20,000 by 2025 reflects its strong fundamentals and potential to outperform in the EMS sector.